- Expert•ish Freelancer

- Posts

- EF #36: 💵 The Money Basics for Freelancers—Keeping It Real in 2025

EF #36: 💵 The Money Basics for Freelancers—Keeping It Real in 2025

Getting your money right when freelancing feels harder than ever

I recently got to take my family to see the incredible Cirque Du Soleil Drawn to Life performance at Disney Springs near Orlando, FL.

Welcome to the 36th edition of Expert•ish Freelancer, a newsletter that helps you grow your freelance business with confidence. Get tips, tools, and insights every other Friday to help you save time, make money, and work smarter based on my 35+ years as a freelance writer.

New here? Welcome! 😊 Subscribe for free.

Hi, Friend!

Lately, I’ve had a lot of freelance writers asking me about travel writing and press trips, and it got me thinking. What would I want to know if I were just starting over and trying to break into this niche?

I’m thinking of creating a short, affordable eBook ($5-$10 USD), called something like a Quickstart Guide to Travel Writing. It would cover the basics of how to break into travel writing, building a portfolio, getting invited on press trips, what to expect on a press trip, etc.

If this interests you, I’d love it if you gave me some feedback before I create this resource. Take this quick poll below. ⬇️

How interested would you be in buying a short eBook about how to get started in travel writing and get invited on press trips? |

If you’re interested in being notified about the potential launch (and receiving a subscriber discount), let me know and I’ll put you on the waitlist.

Today’s newsletter highlights how to master the money basics as a freelancer.

🔍 Key Takeaways:

✅ Track income consistently.

✅ Build financial flexibility.

✅ Prioritize realistic planning.

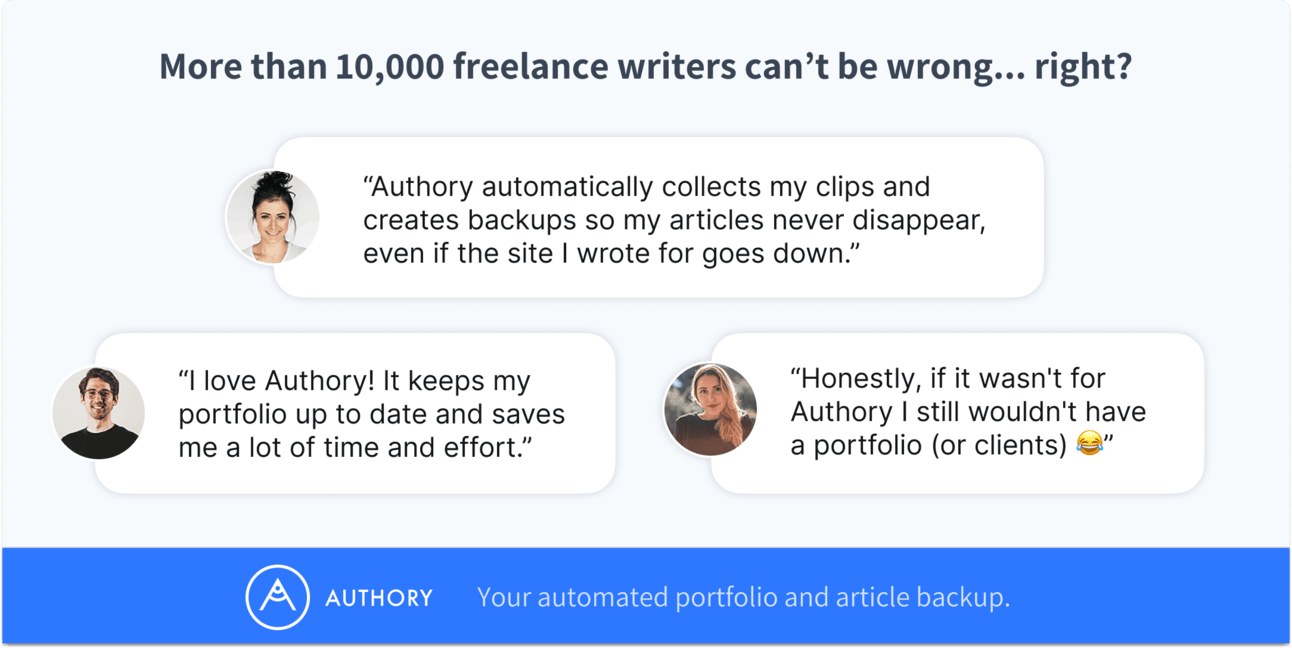

Today’s issue is brought to you by Authory. Sponsors help keep the newsletter free, so please click on their link to check out their offer! ⬇️

Make “portfolio chaos” a thing of the past

Authory saves you hours with a portfolio that's always up-to-date, without you having to lift a finger.

Plus, Authory securely backs up all your articles, protecting you if the original site goes down.

Be ready to impress potential clients and employers, anytime.

Looking for the last newsletter? Find it here: EF #35: 🔥 How My Cold Marketing Outreach Led to New Freelance Work

Here’s your weekend To-Do list to inspire next week’s success.

✅ Learn: If you sell anything to anyone, you’ll want to read the Why We Buy newsletter, which does a deep dive into buyer psychology.

✅ Read: Feel encouraged by Jennifer Goforth Gregory’s poll on how freelancers’ 2025 writing earnings compared to 2024.

✅ Listen: Check out the Creator Science with Jay Clouse podcast Episode #257 How to Build a Creator-First Business (That Actually Lasts).

Know of a good resource? Tell me!

The Money Basics for Freelancers—Keeping It Real in 2025

I don't often talk about money in the Expert•ish Freelancer newsletter. Though it’s critically important to your business, it's not the primary focus of this newsletter.

I'm also not one to push the anyone-can-be-a-six-figure-freelancer mentality. But I absolutely know you can earn that much if you set this as your income goal, create a realistic plan of action, and work hard toward achieving this financial goal.

👉 However, I do think it's important that, no matter how much you earn, you've got to build a firm financial foundation as a freelancer.

You might choose to handle your finances yourself. You might seek guidance from a trusted finance-savvy friend or relative. Or you might outsource it all to a bookkeeper, accountant, and/or financial advisor.

Regardless, you’ve got to build a solid financial💰foundation to sustain and grow your business—even if, like me, you’re not a “numbers person.”

This advice works whether you're earning $500 a month, $5000 a month, or $15,000 a month. The fundamentals remain the same—it's just the scale that changes.

The Reality Check: Why 2025 Feels Different

First, let’s rip the Band-Aid off: freelancing feels harder this year. 😭 So. Much. Harder.

AI is disrupting industries, the economy has everyone on edge, budgets are shriveling, campaigns are paused, and client expectations seem to shift weekly. More people are freelancing than ever, but that also means more competition and complexity.

Dealing with all this change, and figuring out how to pivot your business, is hard enough. But dealing with all this change when your financial life is a mess or you're struggling to pay your bills is a nightmare.

Here's the thing, though—uncertain times actually reward those who are prepared. When everything feels unpredictable, having your money basics locked down isn't just smart business. It's what lets you sleep 😴 at night and say no to clients who aren't right for you.

The Money Basics That Actually Matter

I recently read a great back-to-basics article about the “golden rules“ of freelancer financial success. While I won't repeat everything, a few points really stood out—especially through the lens of what we're all facing right now.

Track Everything (But Keep It Simple)

Income tracking sounds boring, but it's genuinely game-changing. You need to know what's coming in, when, and from whom. This isn't about complex spreadsheets or expensive software—find a system that doesn't make you want to hide under your desk.

While I use QuickBooks for all my invoicing, financial reporting, and tax preparation, I also use a simple Excel sheet for a quick, at-a-glance overview of where my income stands. I can quickly and easily track what I’m earning month by month—and whether or not I got paid. I can also instantly see if I’m meeting my monthly income goals and if I’ve got enough work lined up in the coming months.

Separate Your Money Lives

From day one of launching your business, you should keep business and personal finances separate. If you’ve been in business for a while and haven’t done this yet, I strongly encourage you to head to your bank 🏦 and set up a separate business account ASAP.

This isn't just about making tax time easier (though it does). It's about clarity and confidence. When you can see exactly how your business is performing without your personal spending muddying the waters, you make better decisions.

Create Your Safety Net

While you can call this your “emergency fund,” I like to think of it as your “freelancer 🤑 freedom fund.” This is money that lets you turn down projects that make your stomach churn (goodbye, boring compliance blogs) or take a week off when you're burned out without panicking about rent.

The traditional advice is to save enough money to cover 3-6 months of expenses, but start smaller if you need to. Even $500 in a separate account changes how you approach client relationships. You won’t feel desperate if you’ve got a financial 💵 cushion. This helps you convey confidence when interacting with prospects and clients.

Get Help With What You Hate

In my business, I handle all the basic financial tasks (invoicing, accounts receivable, setting/tracking income goals, etc.).

My husband Kevin helps me with more advanced financial tasks (like filing quarterly taxes, preparing the annual tax return, etc.). Note that Kevin was just a few classes shy of an accounting degree in college, so I'm more than happy 😃 to let him lead the way on many financial issues.

Like my arrangement with my husband, you should find your financial support system. Maybe it's an app that automates invoicing, a bookkeeper who handles the monthly reconciliation, or an accountant who takes care of taxes. You don't have to do everything yourself—and you shouldn't.

The Mindset Shift: Money as Creative Tool

Here's something many freelancers get wrong: they think caring about money kills creativity. The opposite is true. Good money management creates space for better creative work.

👉 Taking a mindfulness approach to your finances gives you clarity, reduces anxiety, and frees up mental energy.

When you're not constantly worried about whether you can pay your bills, you can focus on the work that matters. You can take on projects that excite 🤩 you instead of just ones that pay immediately. You can negotiate for higher fees instead of settling for lower ones. You can invest time in learning new skills or building relationships instead of scrambling for the next paycheck.

Start Where You Are

Whether you're just starting out as a freelancer or you've been freelancing for years, pick one area to focus on this month:

✅ Just Starting Out: Set up one simple tracking system and open a separate business account.

✅ Getting Established: Schedule quarterly money check-ins and start building that freelancer freedom fund.

✅ Seasoned But Scattered: Audit your current systems and identify what's working and what needs to change.

The Honest Truth About This Year

Following financial best practices doesn't guarantee easy success in 2025. But it does guarantee you'll navigate whatever comes next with more confidence and options.

And in a year when so much feels out of our control, having control over your money basics makes everything else feel more manageable.

Remember, financial wellness is a practice, not a destination. Start where you are, use what works, and keep going.

👉 What's your biggest money management challenge right now? Hit reply and let me know—I read every response, and your question might inspire the next newsletter!

Share Your Success Story. I would LOVE to hear how you’ve implemented any of the ideas in Expert•ish Freelancer and found success. I might even include your win in a future newsletter. You can always reach me at [email protected].

Follow me on LinkedIn. I share more freelance tips/insights most weekdays.

Turn to Expert•ish Freelancer’s Tools & Resources page, highlighting valuable resources to help you successfully run your freelance business. You’ll find recommendations for apps, tools, training, services, websites, blogs, podcasts, books, videos, and more! If you’ve got a resource you love, let me know about it.

How would you rate this issue of Expert•ish Freelancer newsletter? |

Thanks for allowing me into your inbox!

I look forward to sharing my freelance journey with you, and I look forward to hearing about yours. I’m just here as your guide. Take what works for you, and tweak it to your needs. Rinse. Repeat.

I’ll be back in two Fridays with another edition of Expert•ish Freelancer.

In the meantime….

Be kind. Do good. Give thanks. 😊

With gratitude,

Lisa Beach

Namaste, freelancers!

FYI: In yoga, the instructor often closes the session by saying “namaste” as a way of acknowledging and honoring the light, spirit, or goodness within each person in the class. 🧘♀️ It’s often used as a closing to convey unity (we’re all interconnected), gratitude (thank you for this shared experience), respect (I respect you and your journey), and peace (may you find peace within yourself). Essentially, it's a way to acknowledge the shared experience and to leave with a sense of peace and connection. 😊